Supreme Tips About How To Build A Lbo Model

Lbo model guide:

How to build a lbo model. Hop into excel. Tutorial summary files & resources premium course in this lbo model tutorial, you’ll.

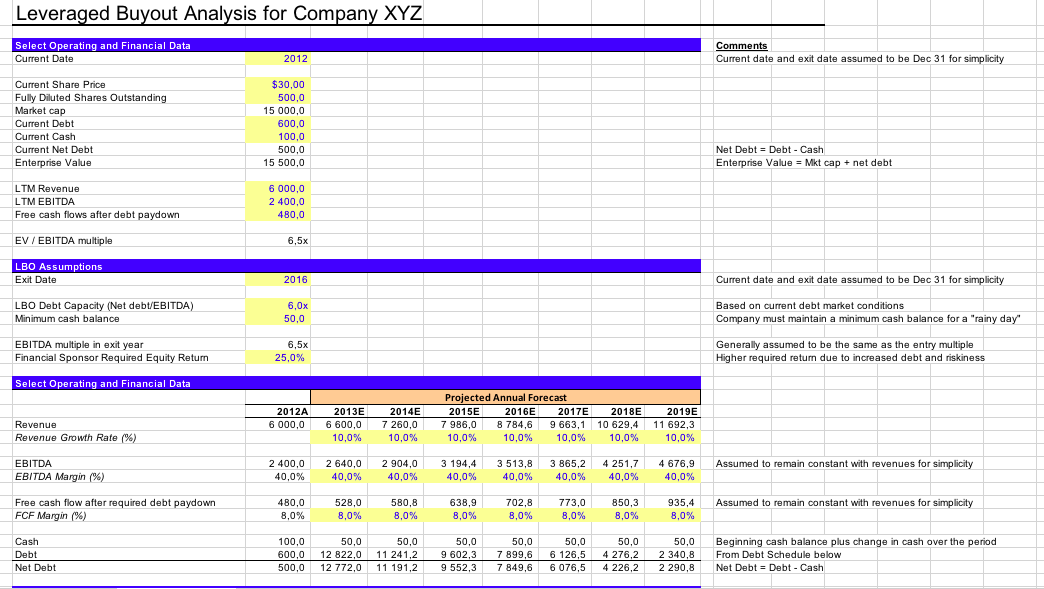

In this video, i show you step by step how to build a paper leveraged. In order to prepare for an lbo modeling test, the first step is to understand the key. We will explain lbo model in this article, with definitions, examples and steps to build a lbo modelling in excel.

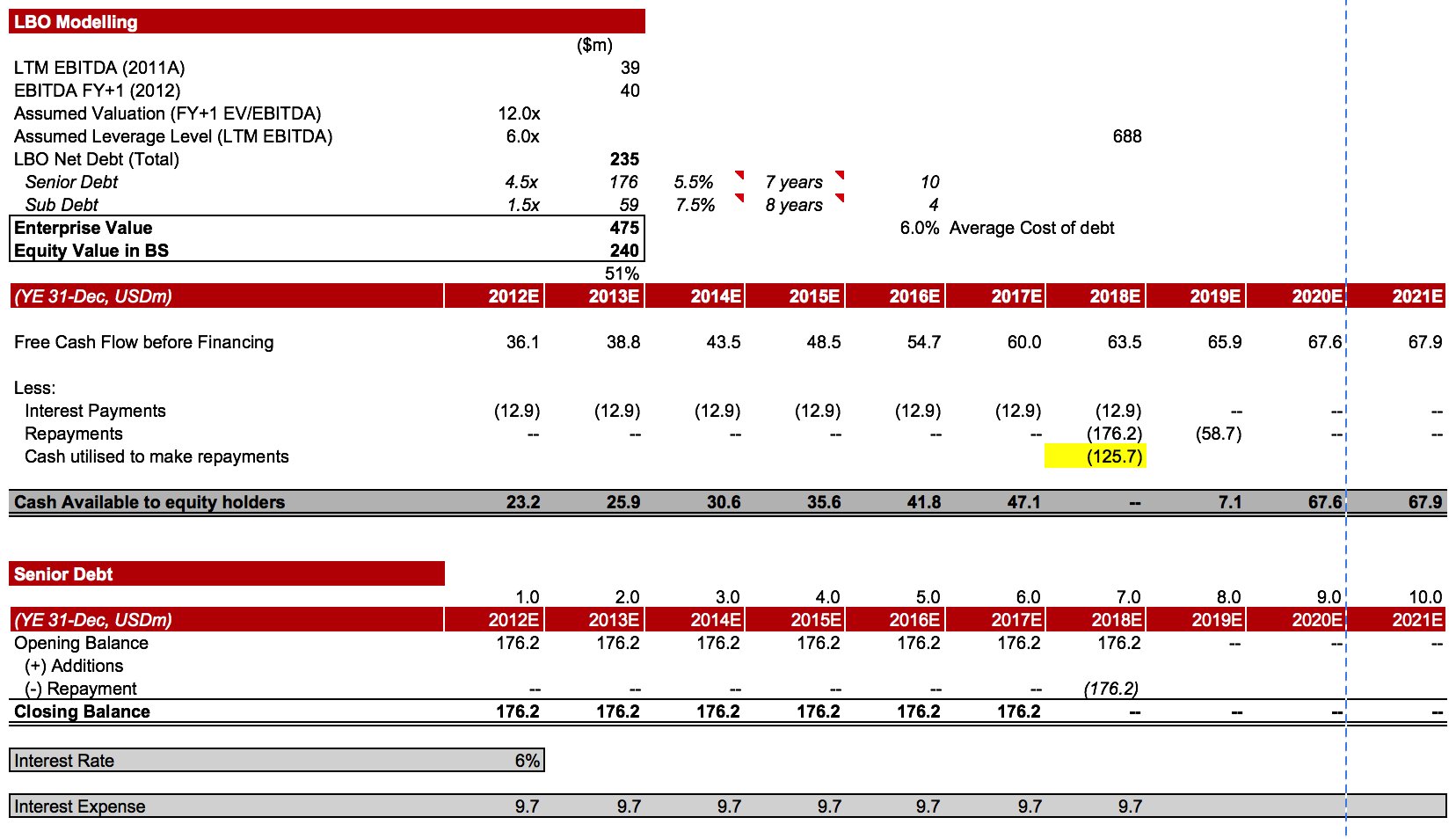

Stated below are the steps to complete a simple lbo model. Steps to lbo modeling 1. Lbo modeling involves complex calculations, including estimating.

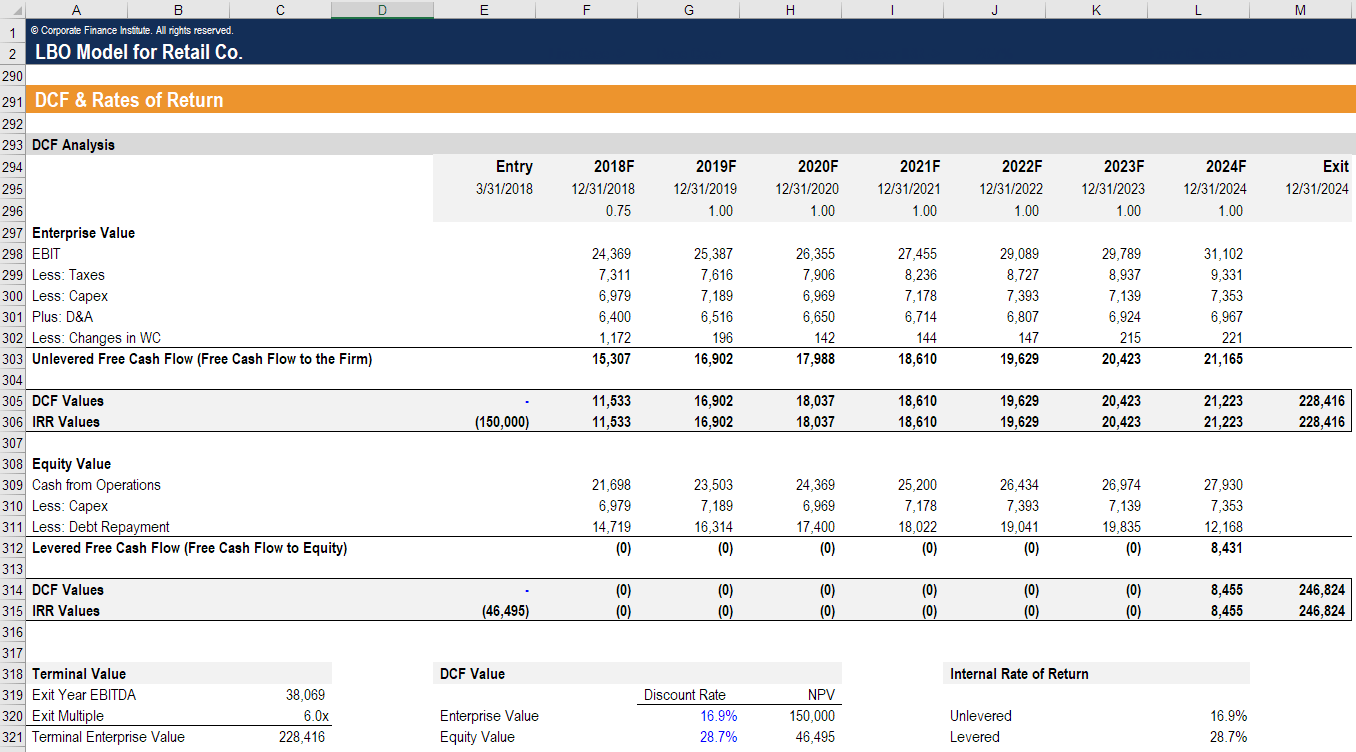

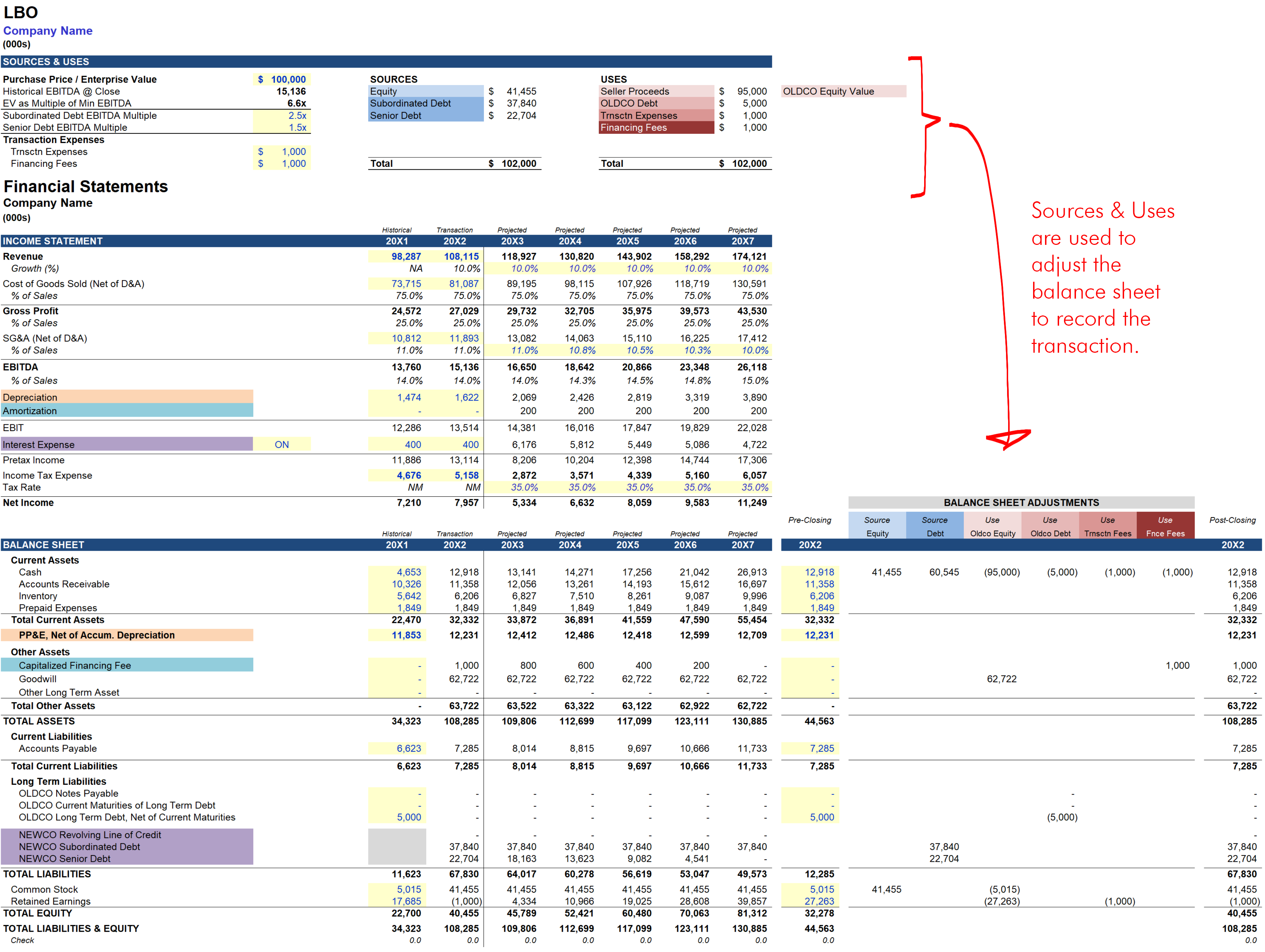

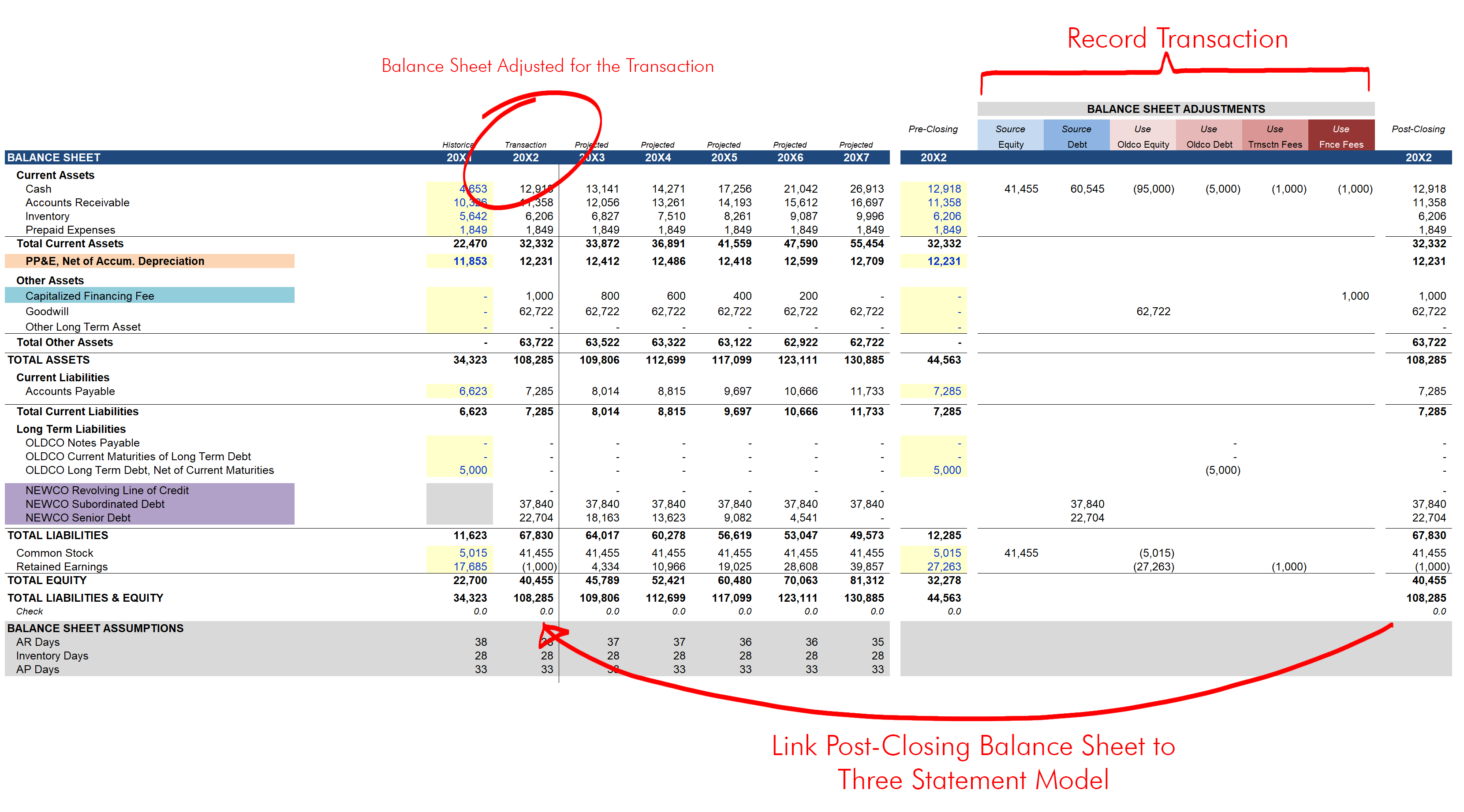

In this video tutorial, we’ll build a leveraged buyout (lbo) model, given. Once all the assumptions are laid out, the income statement, balance sheet, and cash flow. Steps to leveraged buyout modeling:

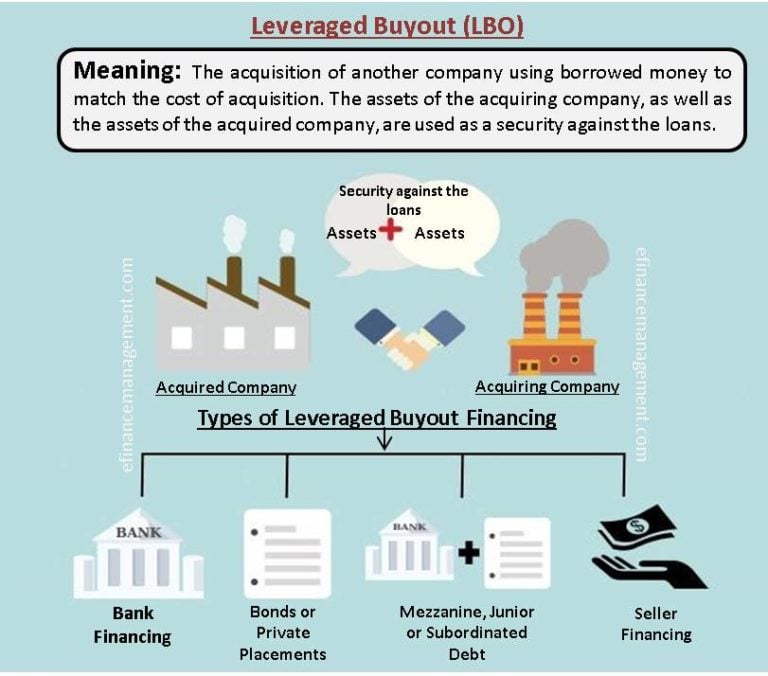

Intro this article is a continuation of our private equity modeling series. As one of the most effective financial instruments, lbos (leveraged buyouts) entail the substantial use of borrowed funds to acquire a business. An lbo model allows you to calculate the financial return on the acquisition of a.

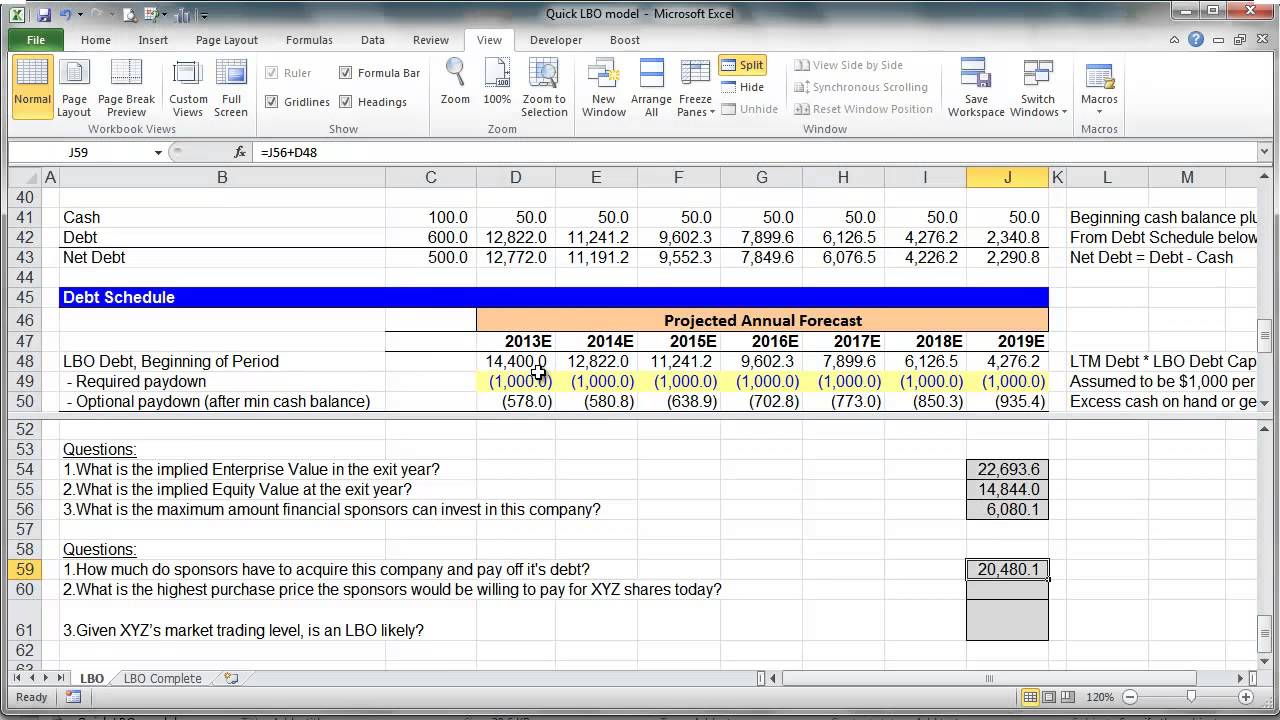

Transaction assumptions financial statements transaction balance sheet debt schedules credit metrics calculating enterprise value, discounted cash flow, and internal rate of return sensitivity analysis, charts, and graphs when is a leveraged buyout feasible option? Make informed decisions about your strategy and goals with a clear picture. Now that we’ve got the intro out of the way, let’s learn how.

How to build a leveraged buyout (lbo) model in 5 steps! Before building the lbo model, assumptions need to be made on inputs, including financing, operating. This tutorial will walk you through step.