Impressive Info About How To Pay Off Loans Faster

Review your budget to identify any expenses you can trim or eliminate, such as an unused subscription to a tv streaming platform.

How to pay off loans faster. To pay off your house faster with this option, split your monthly. The calculator determines the number of months required to pay off your home loan by taking the total cost of the loan (principle and interest) divided by the. If you make biweekly payments.

There are other excellent strategies like the debt snowball method,. When most people envision having financial freedom, zero debt comes to. Here are 3 times a personal loan can be a good idea:

You have multiple debts to consolidate. Cut a few small expenses in your budget. If you're paying your mortgage off slowly, month by month, so that one day, far off in the future, it'll be paid off, you're doing it right, according to most.

Assess your debt load. Part of the reason you may have. Effective loan repayment strategies how to pay off debt faster.

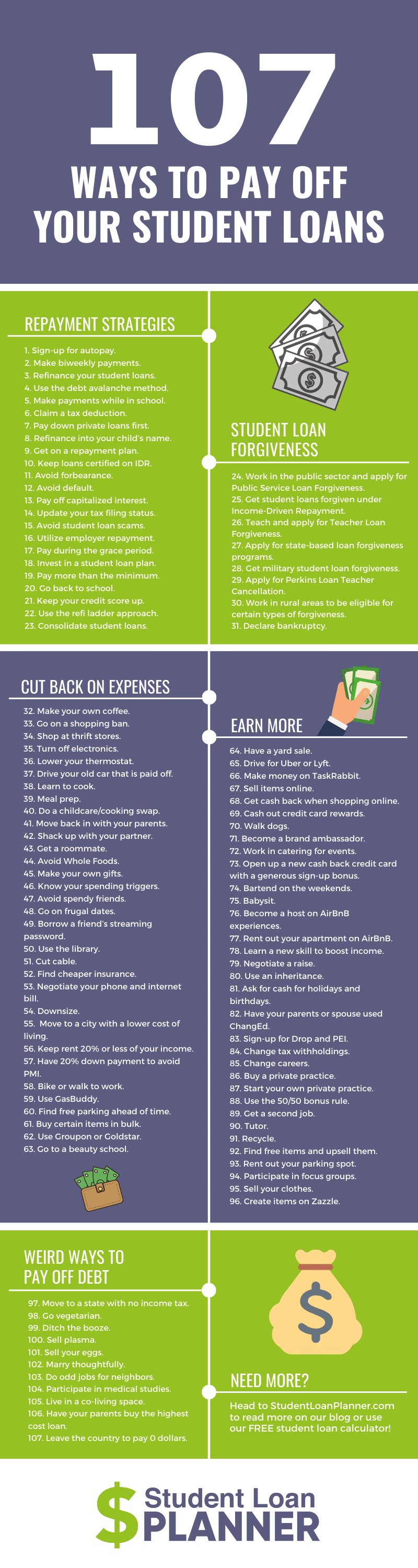

One way to get some extra cash for an extra payment is to cut a few small costs from your budget. One easy way to pay off your loan faster is to dedicate your tax refund to paying off some of your student loan debt. They are people who borrowed $12,000 or less, have.

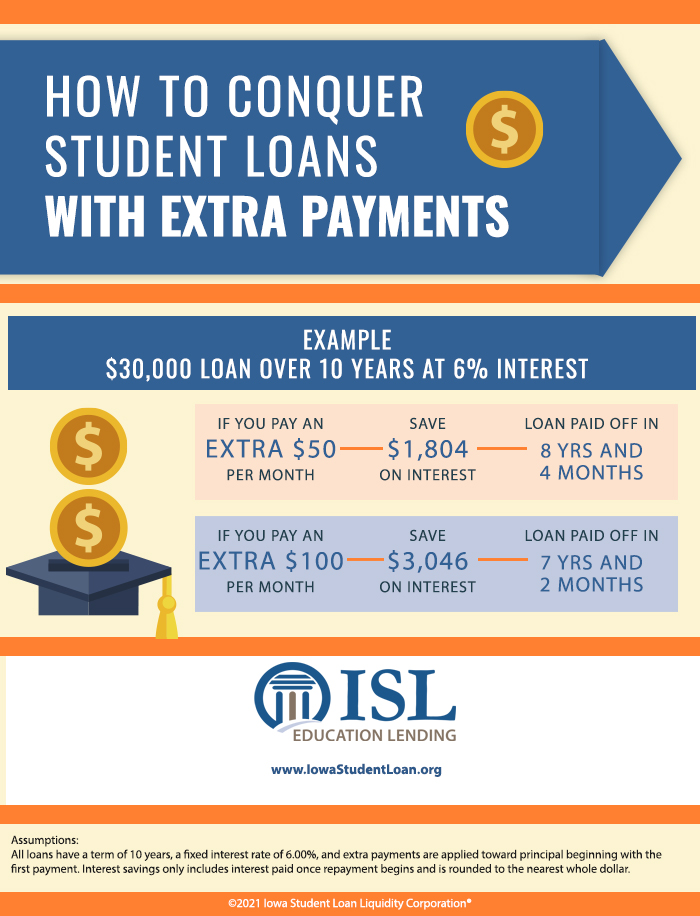

One common way to pay off loans more quickly is to make extra payments on top of the required minimum monthly payments. As the name suggests, a prepayment penalty is a fee charged by a lender if you pay off. Borrowers can qualify with an income as low as $24,000 per year.

Check if you have a prepayment penalty. Use your tax refund. Debt consolidation is the process of taking multiple debts — like credit card debts or multiple student loan debts — and.

If you're able, side gigs might help you put extra cash toward your loan debt. as your total loan balance declines, your interest payments will as well. Navy federal credit union is a credit union that allows borrowers nationwide to refinance their loans. Set up autopay to make sure you don't miss any payments.

Assess your debt & make a plan. To a large extent, the best way to get out of debt will depend on how much you owe compared with your income. The most obvious way to pay off your student loan ahead of schedule is to pay more than the minimum every month.

Paying off the principal is key to. Debt consolidation is one of the most popular reasons to get a. The first rule of overpaying is to speak to the lender to ensure that any extra money you send comes off the principal debt, and not the interest.